Client Portal

Secure File Sharing & Management

Quick Links:

Client Portal | How to Login | Navigating the SaabTeece Client Portal | Uploading Documents | Accessing Help

Our Client Portal Login

Our Client Portal is supported by Microsoft’s SharePoint. To ensure the security of your documents and correspondence, the email address that you use to login must match the email address SaabTeece has as the primary contact for you and/or your entities. We recommend you use the same email address across all entities so you can access all documents with one login.

How to Login

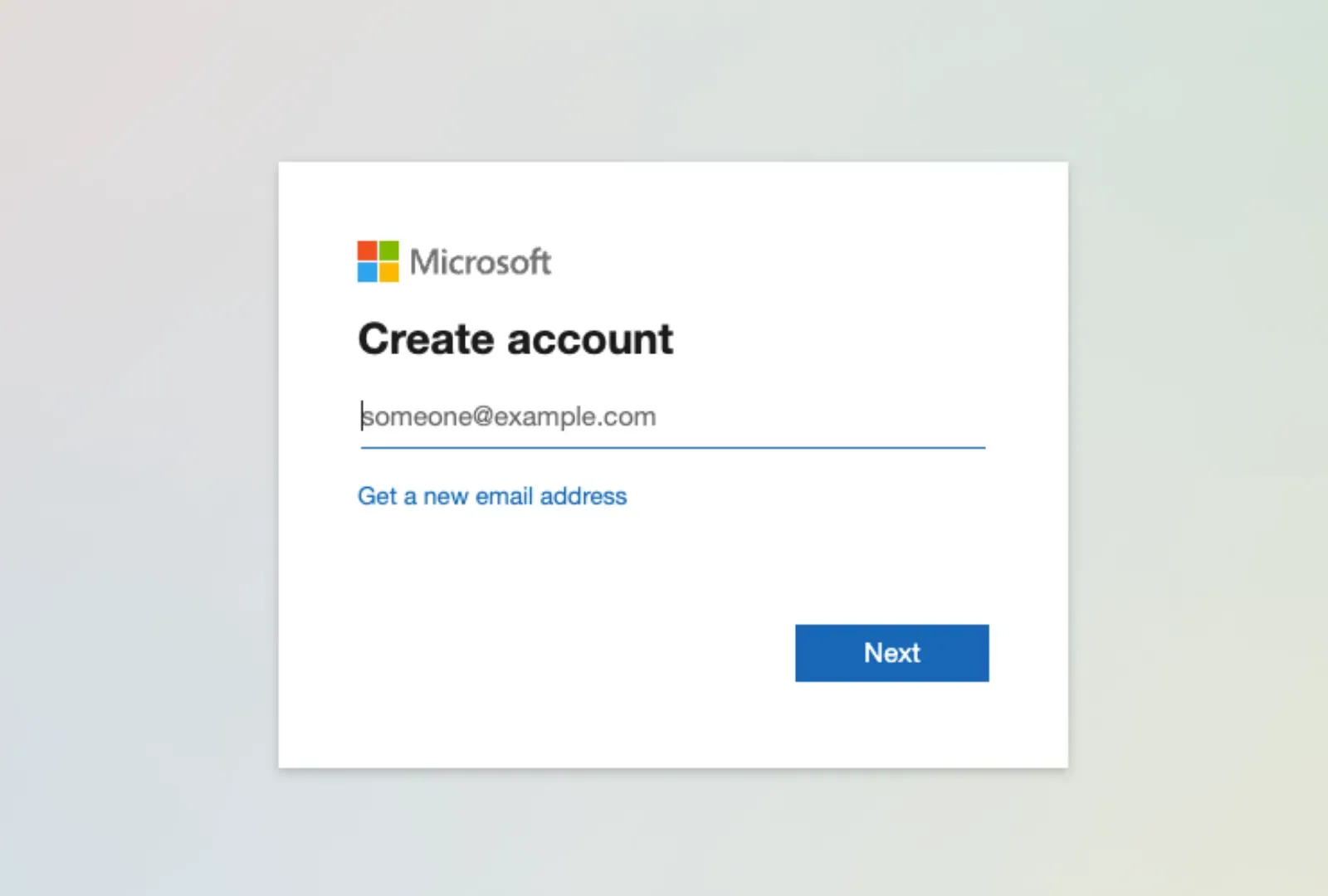

To login to the new client portal, you must have a Microsoft or Gmail domain email address.

Please note that Microsoft includes @hotmail.com, @outlook.com & @msn.com or any email address that is managed on a Microsoft email server (such as your business or work email address).

If you do not have a Microsoft or Gmail email address, you can create a Microsoft login with your existing

email address here.

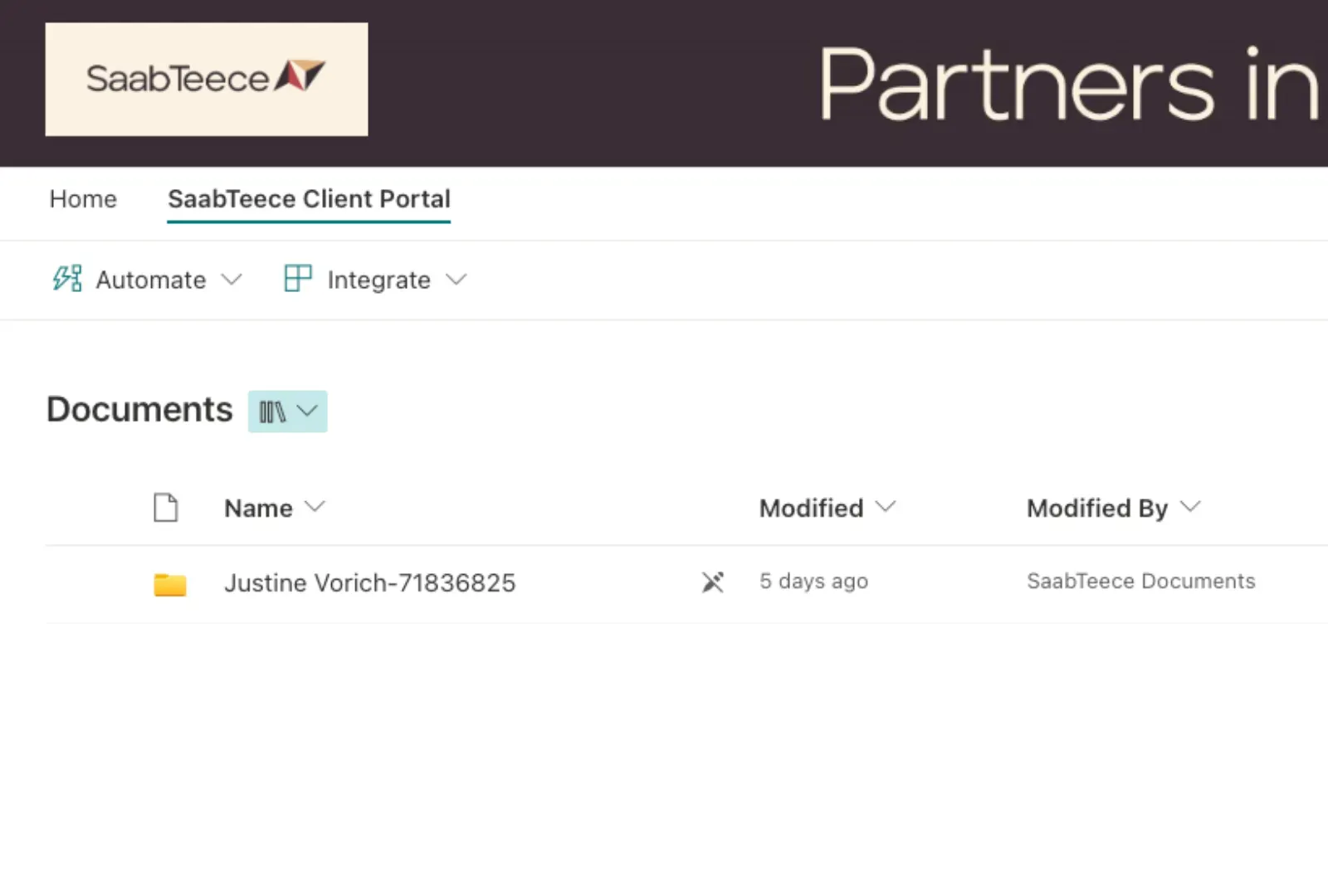

'Documents' page

Once you are on the ‘Documents’ page, a list of all client folders you have access to will appear.

This may include you and your related entities. If there are any entities missing, please contact us so we can rectify this. You will notice that entity and individual names will appear alongside a reference code. Simply click on the folder name to access the contents.

Also, any Word or Excel files shared with you for co-editing will appear in the client folder (this may include forms and checklists).

Please note that when initially invited to our new Client Portal, you may just see an empty folder until we have uploaded documents (such as ATO Correspondence, tax returns or establishment documents).

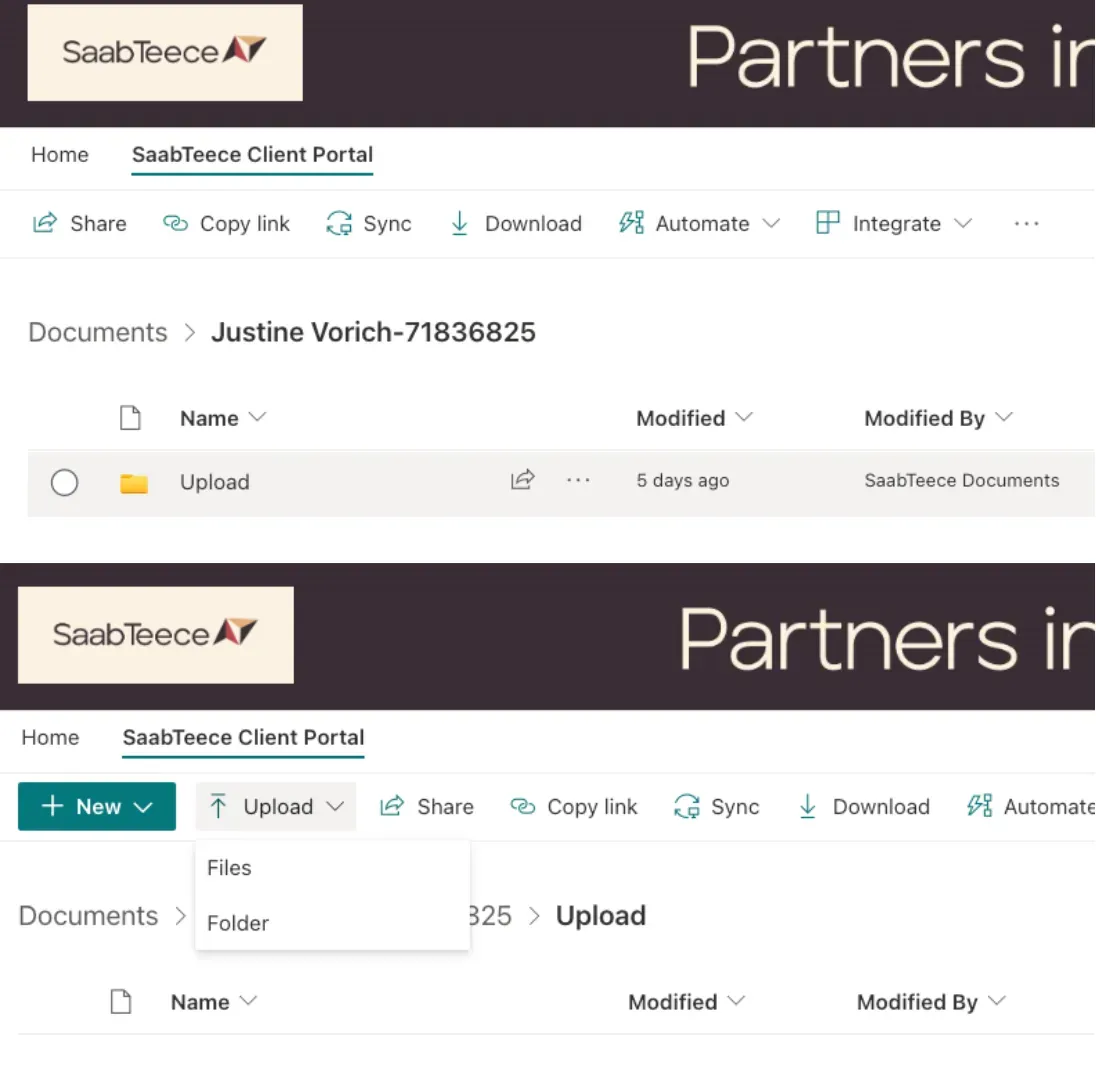

Uploading Documents

Within each client folder there is an uploads folder. This is where you upload documents to share with SaabTeece.

Once within the Upload folder, you can upload files and folders by clicking on the ‘Upload’ button or use the drag and drop feature.

Please note that files will automatically upload to SaabTeece every 10 minutes. After documents have been uploaded, they will be removed from the Upload folder. Automated notifications are sent to SaabTeece client managers every 2 hours to notify them of any documents uploaded.

Accessing Help

Click on the image on the right-hand side containing “How to use the Client Portal” to access these helpful instructions at any time.

Why You Should Use Our Portal?

Once in the portal, you are able to securely upload any information and documentation that may be required for the completion of your BAS’s, Tax Returns etc.

Annual Finance & Tax Uploads

Upon completion of your yearly tax work, we will upload the following documents (if applicable to you) to the portal within the relevant financial year folder:

- Income Tax Returns

- Notices of Assessment

- Financial Statements

You are then able to access and download these files at any time in the future should you need to.

Secure Data Storage

For Companies, Trusts and Superannuation Funds there will be an additional “Permanent” folder where we will store the following for you to access:

- Company incorporation documents

- Trust establishment documents

- Super Fund establishment documents

- Change of ownership/control documents (such as share transfers, officeholder resignations etc)

- ATO registration documents (such as ABN, TFN, GST, PAYG)

Accessable Files

You are then able to access and download these files at any time in the future should you need to.

Should you require any assistance in setting up or using the portal, please do not hesitate to contact us.

Access to the New Client Portal

If you have not been given access to your client portal yet, please click here or contact us using the form on the right.