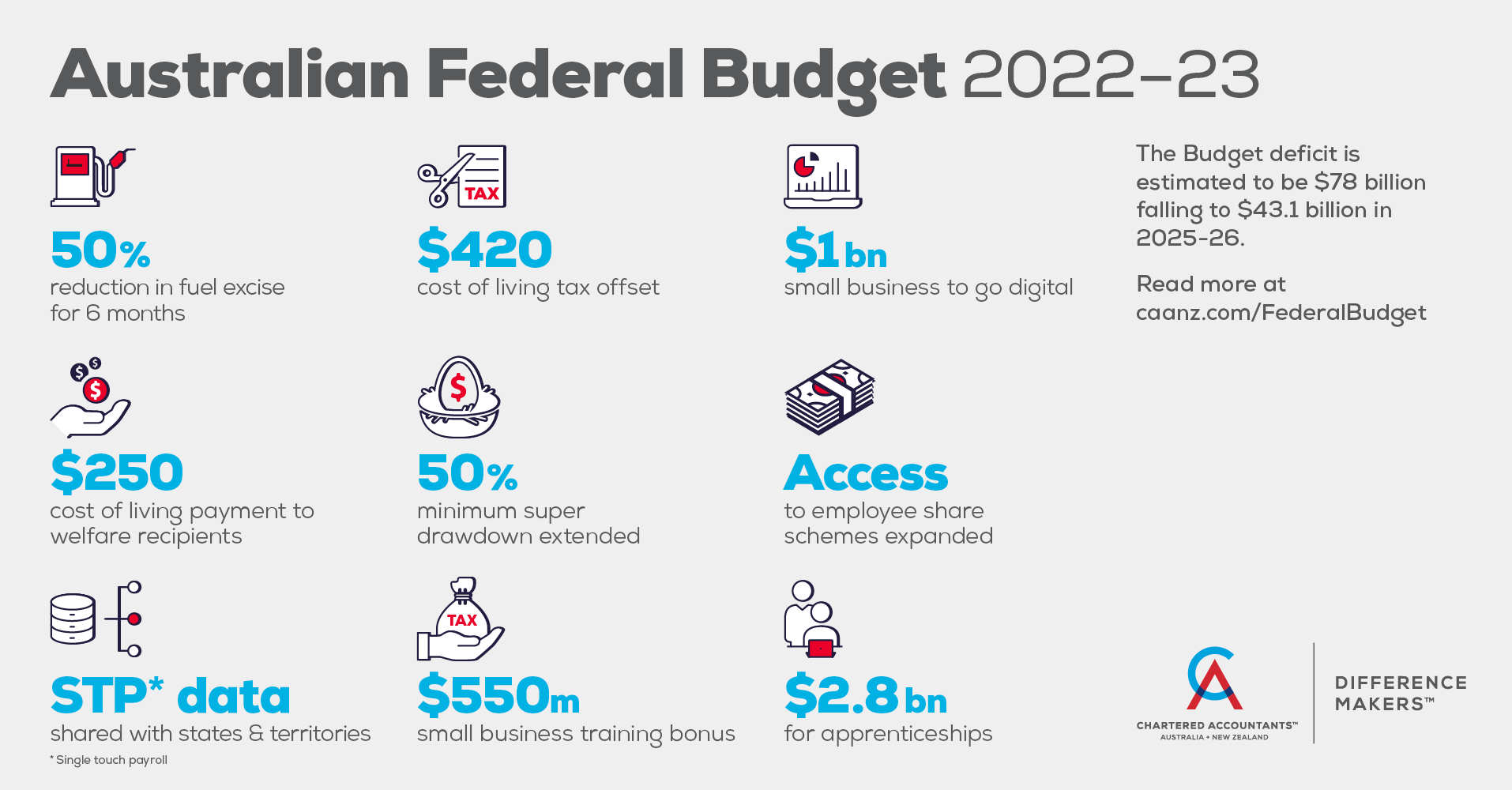

2022-23 Budget Summary

On Tuesday night, Treasurer Josh Frydenberg handed down an election friendly budget. Some of the key measures are detailed below.

Measures Already Legislated

The Legislation for these measures passed both houses of parliament on 30th March and await Royal Assent Treasury Laws Amendment (Cost of Living Support and Other Measures) Bill 2022.

Temporary Reduction in Fuel Excise

- Temporary reduction of the fuel excise tax from 30 March to 28 September 2022.

- This will result in the price of fuel being reduced by 22.1 cents per litre.

Increase to the Low to Middle Income Tax Offset (LIMITO)

- One off tax offset claimed in the 2022 individual tax return.

- If your taxable income is below $126,000 you will receive a $420 reduction in your tax liability.

- Please note this is a tax offset, not a cash payment.

Cost of Living Payment

- Once off $250 payment.

- Payment will automatically be paid to eligible pensioners, welfare recipients, veterans and eligible concession card holders in April 2022.

Varying the GDP uplift factor for tax instalments

- Ordinarily PAYG and GST instalments increase by 10%.

- The government has announced that in the 2023 income year the increase will only be 2%.

Deductibility of Covid-19 Tests

- The cost of taking a Covid-19 test to attend a place of work are tax deductible.

- Applies from 1 July 2021.

The budget measures detailed below are yet to be legislated and will most likely not be tabled in parliament until after the Federal election.

Individuals & Families

Changes to Paid Parental Leave

- The government will be making changes to the Paid Parental Leave (PPL) & Dad and Partner Pay (DAPP) schemes.

- Under the new scheme the two existing schemes will be merged into one 20-week entitlement paid at the national minimum wages and can be taken flexibly by either parent.

- The eligibility threshold will be raised to a household income of $350,000.

Home Guarantee Scheme Extended

- From 1 July 2022.

- First Home Guarantee will increase to 35,000 applicants.

- Single Parent Family Home Guarantee: 5,000 guarantees with a deposit as low as 2%.

- Introduction of a Regional Home Guarantee.

Business & Employers

Technology & Investment Boost

- 120% tax deduction for expenditure incurred on expenses and assets incurred to support digital adoption.

- Available to small businesses with turnover less than $50M.

- Expenses incurred from 7:30pm 29 March 2022 to 30 June 2023.

- Deduction will be claimed in the 2023 tax return.

- Annual cap of $100,000 will apply.

Technology & Investment Boost Skills and Training Boost

- 120% tax deduction for expenditure on external training courses provided to employees.

- Available to small businesses with turnover less than $50M.

- Expenses incurred from 7:30pm 29 March 2022 to 30 June 2024.

- Deduction will be claimed in the 2023 and 2024 tax return.

- Annual cap of $100,000 will apply.

Modernising the PAYG Instalment System

- Companies will be able to choose to have their PAYG instalments calculated based on current performance.

- Will use data sharing capability from accounting software.

- Expected to commence from 1 January 2024.

Making Covid-19 Business Grants tax free

- The list of Grants that have been deemed non-assessable non-exempt has been extended to include:

- New South Wales Accommodation and Support Grant

- New South Wales Commercial Landlord Hardship Grant

- New South Wales Performing Arts Relaunch Package

- New South Wales 2022 Small Business Support Program

Facilitating pre-filling of payroll tax returns through data sharing (with the states)

- Government IT infrastructure will be improved to allow payroll data to be shared with the states.

- This will allow the states to pre-fill Payroll Tax data for payroll tax returns.

Digitising Taxable Payments Annual Reporting (TPAR)

- Contractor details to be shared through accounting software and be linked to the Business Activity Statement (BAS) reporting cycle.

Apprentice wage subsidy support extended

- The Boosting Apprenticeship Commencements (BAC) & Completing Apprenticeship Commencement (CAC) have been extended by three months to 30 June 2022.

Superannuation

Extending the reduction in minimum drawdowns

- The temporary 50% reduction to minimum pension drawdowns will be extended to 30 June 2023.

For more details on any of the measures above, please click here.

Recent Posts